DDCE LTD International Land Development. We specialize in the acquisition and preparation of land for residential development. Our main focus is the long-term securing and preparation of land for developers.

UK: +44 7542097385, Republic of Ireland: +353 892300383, Poland: +48 502403720

Development land warszawa, Development land gdańsk, Development land poznań, Developer Land, Investment land, developer will buy land, Developer, Development land, Buy land, Sell land, Land for developer, Land for developer, Land for developer, Service land for sale, Industrial land for sale, Land for sale, Land and plots for sale, Land and plot adverts, Land for multifamily development, Land for single-family development, Land for service development, Looking for land, Land, Offer for developers, Development land Szczecin , Development land Bydgoszcz , Development land Lublin , Development land Białystok , Development land Katowice, We will buy land

datajacek@gmail.com

-

Development land Poznań

Buy Now -

Development land Warszawa

Buy Now -

Development land Gdańsk

Buy Now -

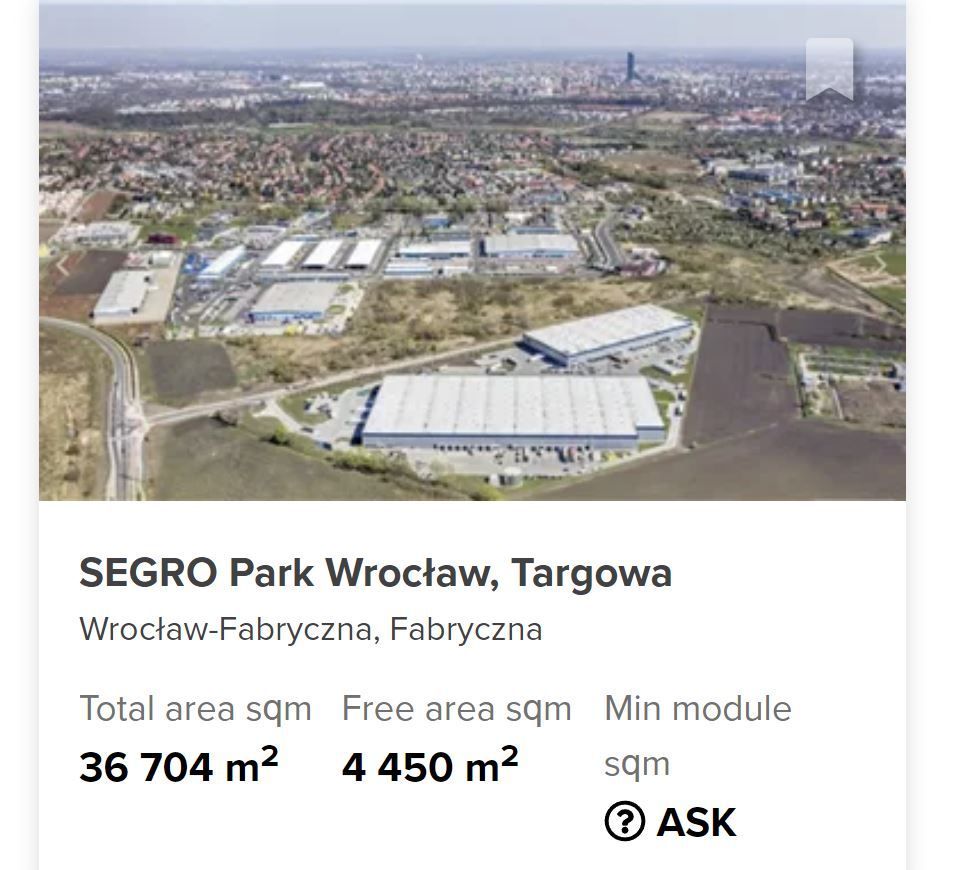

Development land Wrocław

Buy Now -

Development land Świebodzin

Buy Now -

Development land Gorzów Wielkopolski

Buy Now -

Development land Łódź

Buy Now -

Development land Kraków

Buy Now -

Development land Szczecin

Buy Now -

Development land Bydgoszcz

Buy Now -

Development land Lublin

Buy Now -

Development land Białystok

Buy Now -

Development land Katowice

Buy Now -

Development land Gdynia

Buy Now -

Development land Częstochowa

Buy Now -

Development land Radom

Buy Now -

Development land Rzeszów

Buy Now -

Development land Toruń

Buy Now -

Development land Kielce

Buy Now -

Development land Sosnowiec

Buy Now -

Development land Gliwice

Buy Now -

Development land Olsztyn

Buy Now -

Development land Zabrze

Buy Now -

Development land Bielsko-Biała

Buy Now -

Development land Bytom

Buy Now -

Development land Zielona Góra

Buy Now -

Development land Rybnik

Buy Now -

Development land Ruda Śląska

Buy Now -

Development land Opole

Buy Now -

Development land Elbląg

Buy Now -

Development land Płock

Buy Now -

Development land Dąbrowa Górnicza

Buy Now -

Development land Wałbrzych

Buy Now -

Development land Włocławek

Buy Now -

Development land Tarnów

Buy Now -

Development land Chorzów

Buy Now

Grunty Deweloperskie - Kupimy grunty

Jeżeli posiadasz w swojej ofercie nieruchomość, na której moglibyśmy zrealizować kolejną inwestycję, serdecznie zapraszamy do kontaktu. Współpracujemy zarówno bezpośrednio z właścicielami gruntów, jak również z pośrednikami nieruchomości.

W sprawie zakupu nieruchomości jesteśmy dostępni pod adresem e-mail:

datajacek@gmail.com

Poszukujemy następujących gruntów:

Tereny pod zabudowę jednorodzinną (pozwalające na budowę minimum 8-10 domów lub segmentów jednorodzinnych w ramach jednej inwestycji) lub wielorodzinną (pozwalające na budowę budynku wielorodzinnego min. ok. 1000 m2 powierzchni użytkowej mieszkań).

Tereny objęte miejscowym planem zagospodarowania przestrzennego lub prawomocną decyzją o warunkach zabudowy. Dla pozostałych działek możemy przeprowadzić proces uzyskania decyzji o warunkach zabudowy w ramach zawartej umowy przedwstępnej nabycia nieruchomości.

Nieruchomości o uregulowanym stanie właścicielskim i prawnym, z możliwością spłaty przez DHD ewentualnych zobowiązań właścicieli w ramach rozliczenia części ceny.

Lokalizacja: Gdańsk, Kraków, Wrocław, Warszawa i bezpośrednie okolice

wymogi: dostęp do drogi publicznej, dostępność mediów bezpośrednio na działce lub w drodze publicznej (woda, kanalizacja, prąd, gaz, telekomunikacja), bliskość infrastruktury społecznej (sklepy, przedszkola, szkoły, itp.).

Oferujemy:

Przejrzysty, uczciwy sposób negocjacji warunków zakupu nieruchomości;

Godziwą cenę za nieruchomość, adekwatną do jej rzeczywistego potencjału inwestycyjnego;

Możliwość zawarcia w pierwszej kolejności umowy przedwstępnej w formie aktu notarialnego, pozwalającej Sprzedającemu na przygotowanie się do przyszłej sprzedaży (wyprowadzka, spłata hipotek), a nam na zgromadzenie dokumentów niezbędnych do dalszej realizacji inwestycji;

Bezpieczny dla Sprzedającego sposób płatności (przelew w dniu aktu notarialnego lub możliwość wcześniejszej wpłaty środków na depozyt notarialny, możliwość ustanowienia dodatkowych zabezpieczeń dla płatności).

Contact Us

The industrial sector of the commercial real estate market has many compelling perks that make it a great place to invest.

While all investments carry some risk, industrial properties tend to maintain a certain level of stability that other sectors don’t always carry. Let’s take a look at some of the reasons why.

But first, let’s answer the question: What is industrial real estate?

WHAT IS INDUSTRIAL REAL ESTATE?

Industrial property refers to any commercial property used specifically for industrial purposes. For example:

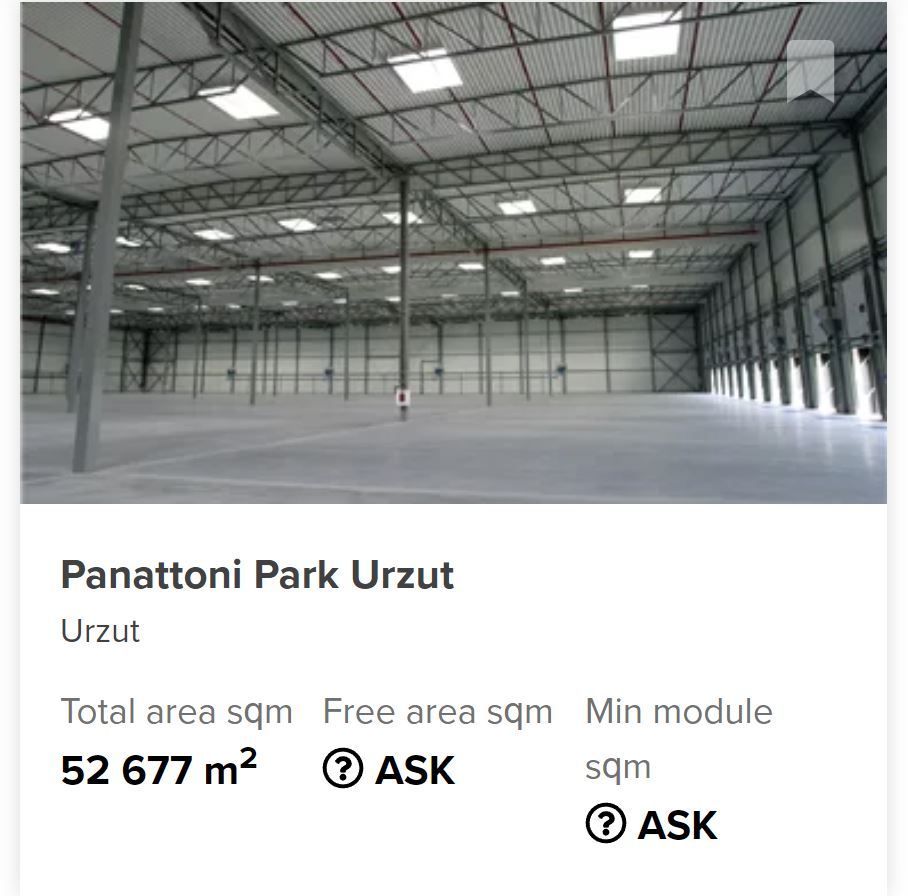

- Warehousing

- Manufacturing

- Storage

- Logistics

- Showrooms

Now, let’s discuss eight great reasons to invest in industrial real estate.

GREATER DIVERSITY

Typically, in commercial real estate, a property that falls into a particular category must be used for that specific purpose. Office space, for example, could not be used as a multifamily property any more than a multifamily property could be used as a retail storefront.

With industrial property, however, there are multiple potential uses for it giving it a greater ability to fluctuate with the changing demand of the market. If, for example, demand is low for warehouses in an area but high for storage facilities, industrial property has the flexibility to be advertised as either.

Additionally, one industrial property can have multiple uses, making it appealing to a broader range of businesses. One large warehouse building can be sectioned into separate spaces for storage, production, and office use.

Read on to see how warehouses are being converted into office space.

HIGH DEMAND

Largely due to the aforementioned adaptability, industrial properties tend to sit vacant for far less time on average than other types of commercial real estate.

In fact, earlier this year we wrote an article detailing the phenomenon of America’s warehouses running out of space.

Demand for these types of properties continues to stay high because every product we encounter has passed through an industrial property in one capacity or another. In other words, these properties are indispensable.

This doesn’t seem to be changing anytime soon, either, as e-commerce continues to flourish, creating an even larger need for larger-scale fulfillment centers.

LONG-TERM INCOME OPPORTUNITIES

A property that remains occupied is a benefit to the investor for multiple reasons, among them the promise of steady, long-term income.

Due to the sheer mass and volume of moving an industrial business from one property to another, industrial leases tend to be on the longer side and tenants are much more likely to renew their lease when the opportunity presents itself as opposed to packing up and relocating.

HIGHER RENTAL YIELDS

While traditional office space shows promising returns of around 5% on investments and retail even larger returns of about 6%, industrial real estate tops them both.

Yields on industrial space fall anywhere between 6 to 7.5%, making these types of commercial property investments a clear choice.

LESS MAINTENANCE

Owning a commercial property does come with its fair share of overhead. There will be upgrades, repairs, and renovations that will be necessary throughout your ownership. These can become both costly and time-consuming.

With industrial real estate, however, the maintenance required is far less than in other sectors. Because most industrial properties are big, open areas with poured concrete floors and high, exposed ceilings, the need for items like flooring, soundproofing, high-end fixtures, and other additional expenses are reduced or eliminated.

GREATER TENANT RESPONSIBILITY

In addition to less maintenance required by the investor, there’s also the bonus of greater tenant responsibility.

As previously mentioned, tenants in the industrial sector typically have a much greater intention of staying put for a longer duration of time. This means they also have much more invested in the property, as it is a representation of their business.

LESS MARKET SATURATION RISK

It’s far less likely that industrial property will face the issue of oversupply—an over-abundance of available properties compared to the market demand—due largely to many of the reasons previously listed.

As long as consumers are still buying products (of any and every kind), there will always be a need for industrial space, making it a much safer investment option.

EASIER TO LIQUIDATE

Lastly, due to consistently high demand for this type of commercial property, you’re much less likely to find yourself in a situation where you can’t sell.

Industrial properties tend to stay on the market for short periods, making them a much easier way to quickly access cash than other types of real estate investment.

Interested in learning more? Read on to learn about the future of industrial real estate and whether or not it’s a good time to buy a building.

The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

New paragraph

Grunty deweloperskie warszawa, Grunty deweloperskie gdańsk, Grunty deweloperskie poznań, Deweloper Grunty, Grunty inwestycyjne, deweloper kupi działki, Deweloper, Grunty deweloperskie, Kupię grunt, Sprzedam grunt, Grunt dla dewelopera, Grunty dla dewelopera, Działki dla dewelopera, Działki usługowe na sprzedaż, Działki przemysłowe na sprzedaż, Grunty na sprzedaż, Działki i grunty na sprzedaż, Ogłoszenia działek i gruntów

Real Estate, Property, Homes, Investment Property For Sale, Warehouse real estate, Warehouse Space for rent , Warehouse space available, Rent storage areas in Europe, Property Europe, Europe Properties, International real estate, warehousing, storage solutions, logistics, warehouse, storage space, commercial storage, Warehouses, Warehouses for rent, Warehouse space, warehouses for lease, Warehouse space For lease, Warehouse real estate, Investment Property For Sale, Investment Property, Warehouse Solutions, Warehousing Benefits, plot for sale, property for sale, investment property, investment opportunity, landmark, business opportunity, luxury, Global Properties, Real Estate, Land plot sales, Resale properties, Real Estate Investment Poland, Investment Property Poland, Investment Property Europe, European Property Investments, Investment Areas Poland, Best Investment Locations Poland, Investment potential Poland, How to Invest in Poland, Best Investments 2024, Residential Plots, Land investment, Investment areas, residential plots, Plots in Krakow for sale, Plots in Warsaw for sale, commercial plots, poland prime locations, Land plots, Investment plots,, newly built properties, Apartment sales, Hotel sales, Property evaluation, Luxury Villa Rental, Luxury Villa Management, apartment sales, penthouse sales, luxury retreats

#PropertyEurope #EuropeProperties #Internationalrealestate #warehousing #storagesolutions #logistics #warehouse #storagespace #commercialstorage #Warehouses #Warehousesforrent #Warehousespace #warehousesforlease #WarehousespaceForlease #Warehouserealestate #InvestmentPropertyFor Sale #InvestmentProperty #WarehouseSolutions #WarehousingBenefits #plotforsale #propertyforsale #investmentproperty #investmentopportunity #bankya #landmark #businessopportunity #luxury #GlobalProperties #RealEstate #Landplotsales #Resaleproperties #Newlybuiltproperties #Apartmentsales #Hotelsales #Propertyevaluation #LuxuryVillaRental #LuxuryVillaManagement #apartmentsales #penthousesales #luxuryretreats

DDCE LTD Deweloper Grunty, Grunty inwestycyjne, deweloper kupi działki, Deweloper, Grunty deweloperskie, Kupię grunt, Sprzedam grunt, Grunt dla dewelopera, Grunty dla dewelopera